Basel AML Index shows progress in the fight against financial crime in Africa

08 December, 2025

The opinions expressed in this article are solely those of the author, and do not necessarily reflect the opinions or views of the Mo Ibrahim Foundation.

The 2025 Basel AML Index reports encouraging progress in the fight against financial crime in Africa. This leading ranking of money laundering risk in 177 jurisdictions finds progress in 70% of African states. Although financial crime risks remain relatively high across the region, the progress stands in contrast to deterioration in some other regions and suggests that concerted efforts at reform are paying off.

The Basel AML Index is an independent, data-based ranking and risk assessment tool for money laundering and related financial crime risks around the world. It provides jurisdiction risk scores from 0 (lowest risk) to 10 (highest risk), based on data from 17 publicly accessible sources.

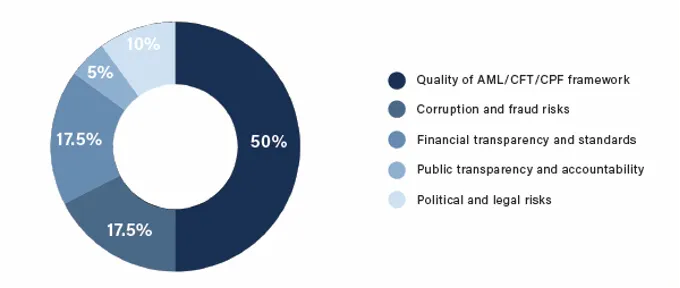

The data cover five domains relevant to assessing risks of money laundering at the country or jurisdiction level: the framework for anti-money laundering and countering financing of terrorism and proliferation (AML/CFT/CPF); corruption and fraud; financial transparency and standards; public transparency and accountability; and legal and political risks.

Figure: The five domains of the Basel AML Index and their weights in the overall score.

African top improvers stand out

The 2025 Basel AML Index shows varied trends across regions. More than half of jurisdictions improved their score while performance deteriorated in 43%. North America, the EU and Western Europe, Eastern Europe and Central Asia, and the Middle East and North Africa all saw slightly higher average risks in the 2025 Index. Other regions saw progress, and Africa in particular stands out with significant improvements, specifically in strengthening the quality of AML/CFT/CPF frameworks, slightly decreased corruption scores and increased financial transparency.

Seven of the top ten improvers in the Index hail from Africa. Two African countries – Burkina Faso and Côte d’Ivoire – moved from the higher-risk to the medium-risk category in the Basel AML Index, which is used by compliance professionals and policymakers seeking to better understand what is driving financial crime risk in each jurisdiction.

| Top 10 improvers (score ↓) | Top 10 decliners (score ↑) |

| Liberia, Mozambique, Burkina Faso, Nigeria, Mali, Tanzania, Côte d’Ivoire, Armenia, Philippines, Croatia | Kazakhstan, Lithuania, Taiwan (Chinese Taipei), Serbia, Costa Rica, Germany, Suriname, Barbados, Greece, Nicaragua |

Financial Action Task Force looms large

Progress in fighting financial crime in Africa reflects countries’ efforts to address deficiencies identified by the Financial Action Task Force (FATF), the international body established to set standards and monitor efforts to counter money laundering and terrorist and proliferation financing.

2025 saw six African countries – Burkina Faso, Mali, Mozambique, Nigeria, South Africa and Tanzania – removed from the so-called FATF grey list of countries subject to increased monitoring. Their removal recognises their progress in addressing deficiencies in their AML/CFT/CPF frameworks as per a detailed Action Plan agreed with the FATF. The Basel Institute on Governance has supported these efforts in a number of countries, for example providing intensive training and legal reform assistance to counterparts in Mozambique in support of their successful three-year effort to be removed from the grey list.

With a new round of FATF reviews under way, it will be important for states to continue to make progress. Some states removed from the grey list in the past have failed to sustain their efforts, only to find themselves facing grey-listing once again. While the progress in many countries in Africa is impressive, across the region the average risk remains high (Basel AML Index score of 6.14). Moreover the emergence of new risks – such as those from the rapidly developing use of virtual assets for criminal purposes – means that no jurisdiction can rest on its laurels.

Data and analysis are essential

The Basel AML Index can be a powerful diagnostic tool for those working to address these challenges. The Expert Editions of the Index – available free of charge to public sector, non-profit, and academic subscribers – give users more granular, up-to-date data and a powerful interface for exploring and analysing each of the 17 indicators for 203 jurisdictions.

The Expert Edition Plus option includes a detailed comparative analysis of the FATF data that is incorporated into each Index score. Subscribers to that edition also benefit from quarterly data updates, analyses of global and regional trends in FATF compliance, summaries of FATF results for newly assessed countries, and identification of jurisdictions at risk of grey-listing.

These tools are designed to serve as a resource for practitioners and policy makers working to strengthen the integrity of financial systems. We are pleased to see the Index put to good use and supporting progress in Africa and would be happy to answer questions or provide assistance to those working in this field. Please send your questions to index@baselgovernance.org.