Trade data and findings from the IIAG

01 October, 2021

With the long-awaited launch of the African Continental Free Trade Area (AfCFTA) in January 2021, trade is at the centre of the debate around Africa’s COVID-19 recovery. The global economic fallout of the coronavirus pandemic and has sent the African continent into a historic recession, with 41 countries experiencing a decline in their gross domestic product (GDP) across 2020. However, there is optimism that a post-COVID recovery under AfCFTA can provide the launchpad for structural transformation that addresses the underlying issues that the pandemic laid bare.

Growth model centred on external trade

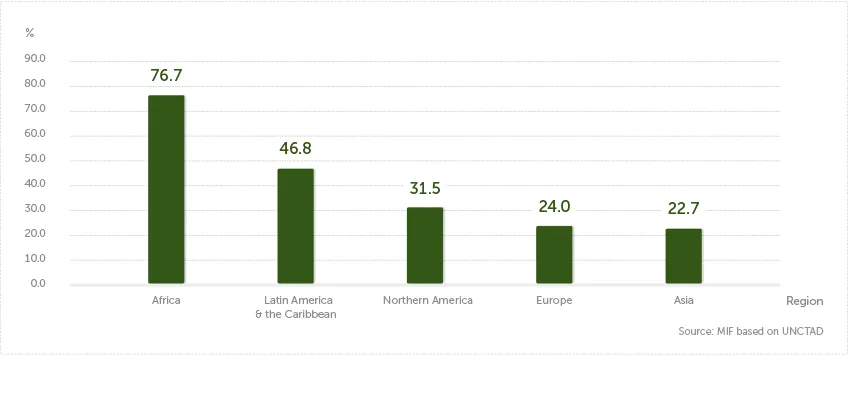

Selected world regions: primary commodities, precious stones & non-monetary gold as % of total exports (2019)

Africa’s growth model heavily relies on external demand for primary commodities, that act as a source of revenue and foreign exchange for both governments and the private sector alike. However, this leaves economies highly sensitive to fluctuations in global demand.

Finished products also tend to be imported from overseas, leaving the continent vulnerable to supply chain disruption.

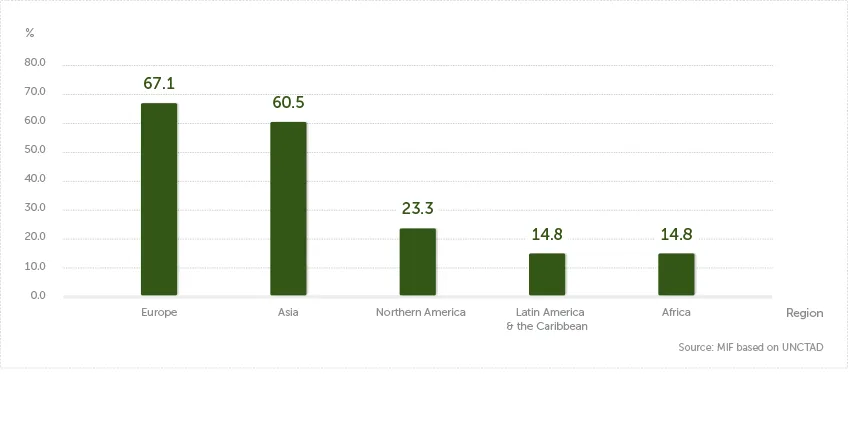

Intra-African trade is low, accounting for only 14.8% of the continent’s trade in 2019. The cost of trading with neighbours is often higher than trading outside the continent due to weak intra-African infrastructure and burdensome customs procedures.

Selected world regions: intra-regional trade as % of total (2019)

The AfCFTA as a vehicle for structural transformation

In committing signatories to the removal on 90% of tariff barriers, it is hoped the AfCFTA will act as a vehicle of structural transformation, spurring intra-regional trade and building African supply chains for key goods.

However, the implementation of the AfCFTA is not just about signing commitments or opening borders to intra-continental trade. The AfCFTA requires a conducive governance environment to start tackling the non-tariff barriers trade.

The IIAG and trade

The 2020 Ibrahim Index of African Governance (IIAG) includes several key governance measures that can assess country performance in laying the foundations for inclusive trade.

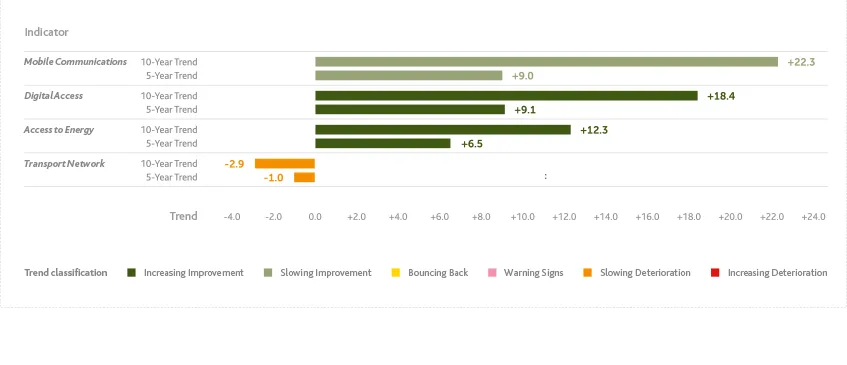

Quality and interconnected infrastructure will be essential for facilitating intra-continental trade. Between 2010 and 2019 Infrastructure (+12.8) was the IIAG's most improved sub-category, thanks to the proliferation of accessible and affordable mobile phones and internet, and an increasing share of households with a computer and secure, fast internet access. Provision of energy has also substantially improved, with the share of Africans with access to electricity growing at an increasing rate. However, these gains mask declines in parts of the transport network such as air travel and postal services.

Africa: Infrastructure indicators, average trends & trend classifications (2010-2019 & 2015-2019)

Mobile Communications: most improved IIAG indicator over 10-year period

Digital Access: most improved IIAG indicator over 5-year period

Administrative efficiency is also essential to facilitating smooth cross border trade. Concerningly, progress in the Public Administration (+0.1) sub-category since 2010 has almost stalled, with a decline in budgetary and financial management, as well as the capacity of national statistics systems offsetting progress in other areas such as taxation capacity.

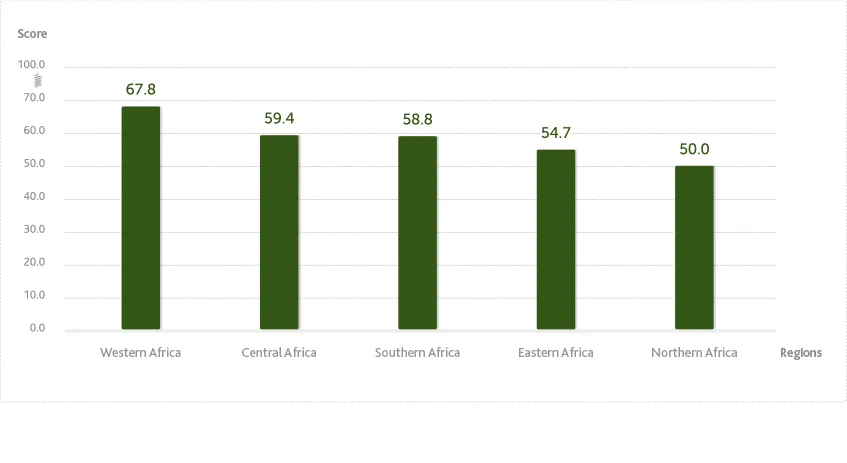

The Regional Integration indicator provides an oversight of regional integration efforts prior to the launch of the AfCFTA. The data show that between 2010 and 2019, African governments on average increased their regional integration efforts. In 2019, governments in Western Africa were on average the most active in pushing regional integration, while the Northern African governments were the least active on average. However, of the regional economic communities (RECs), East African Community (EAC) member states outperform Economic Community of West African States (ECOWAS) member states in regional integration efforts.

African geographic regions: Regional Integration average score (2019)